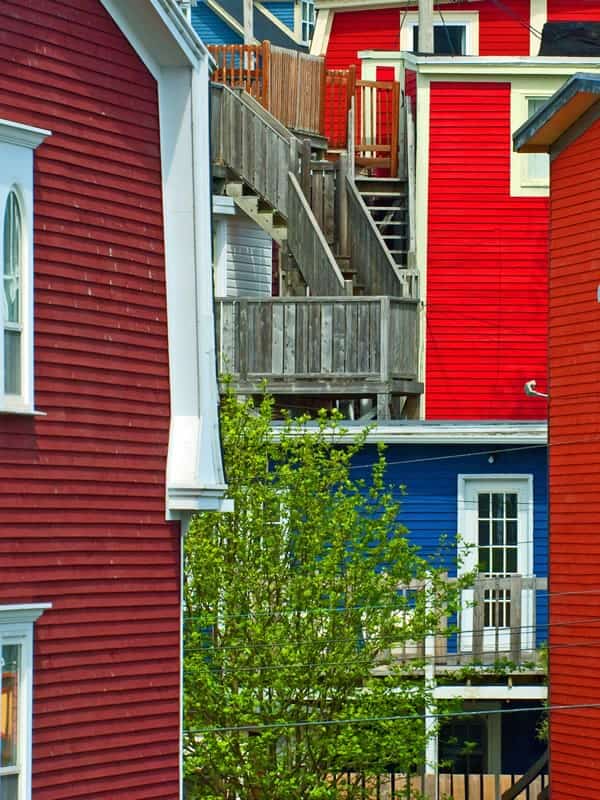

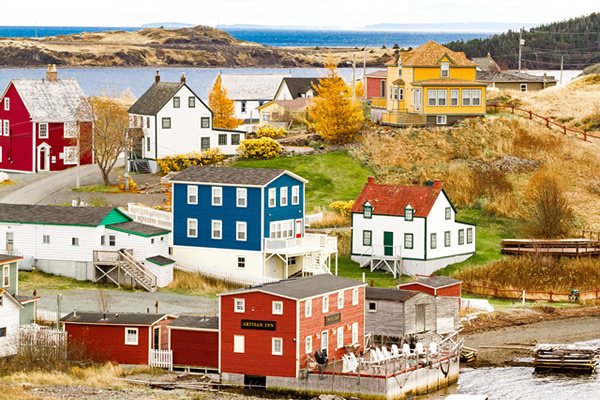

Save on car insurance in Newfoundland.

Save on car insurance in Newfoundland.

We’re one of Newfoundland’s largest independent brokers. We specialize in auto insurance. With a simple online quote or a quick call, you will get quotes from up to eight insurance companies. And with savings of up to 30%, you’ll be on the road with Newfoundland’s best auto protection and benefits. That’s a promise.

Switch to Munn

It’s Simple 😉

Real people.

Our customers love to save.

I am incredibly impressed with Munn. The person I spoke with really cared about my needs and didn’t brush me off as some competitors try to do.

Lisa is the bomb. We are in Ontario and she made it so easy for us. Thanks Lisa at Munn Insurance.

I thought it would be difficult to switch from my current insurer – but my new policy was easy to set up! Plus I saved on my car and home insurance.

Real people.

Our customers love to save.

I am incredibly impressed with Munn. The person I spoke with really cared about my needs and didn’t brush me off as some competitors try to do.

Unique benefits of a Munn Insurance auto policy.

Great additional features that come standard with your car insurance policy from Munn Insurance:

- Unbeatable customer care – we will show you the love

- Easy monthly payments – unparalleled convenience

- Discounts, discounts and more discounts – too many to list them all

- Accident forgiveness – the best available

- Local, fast and efficient 24-7 claims service

- Combine your home and auto policy and save on both – most companies only give the home discount

- Industry leading new vehicle 30-month depreciation waiver – which is insurance speak for “more money in your pocket!”

Compare auto insurance quotes in Newfoundland and Labrador — and just see what you can do with the savings!

Compare auto insurance quotes in Newfoundland and Labrador — and just see what you can do with the savings!

In Newfoundland and Labrador, auto insurance is available from a wide array of private companies who compete with one another to allow consumers to shop around for a better rate. As an independent broker, Munn Insurance can provide you with quotes from up to eight insurance companies. By calling Munn, or going online for a quote, customers in Newfoundland can easily compare car insurance rates and find the best car insurance and save on their auto insurance premiums.

We do the shopping. You get the savings.

Customers love choice. And they love saving too! At Munn Insurance, we deliver on both. As an independent insurance broker, we shop our extensive network of insurance partners to provide our customers with choices to provide the best coverage at the best rate. Some of the insurance companies we search for our customers include:

Recent Car Insurance Quotes in Newfoundland and Labrador

How Munn Insurance saves you money.

We work for you – that’s what an insurance broker does. We shop the market on your behalf, so Munn insurance can offer you the most access to the best discounts from our insurance partners.

- Bundling (Auto + Home Discount)

- Multiple Vehicle Discounts

- Experienced Drivers Discount

- Safe Drivers Discount

- Claims-Free Discount

- Loyalty Discount

- And Many More

Combine your home and car policies and save.

With Munn Insurance, home and auto policies are better together. It means extra savings and additional coverage. So combine them both and receive a discount on both. That’s like a double discount!

Combining also gives you the extra convenience of aligned renewal rates and less paperwork.

You can combine your auto policy with any Munn Insurance home policy for the following dwelling types:

- Private Homes

- Condos

- Tenants

- Cabins/Cottages

- Rented Dwellings

Special discounts and savings with a Munn Insurance Group policy.

We recognize the value groups provide to Newfoundland communities. First Responders, Health Care Professionals, Alumni Associations, Educators and Instructors all play a vital role in helping others across the Island. They give so much, and we’re happy to give back. Munn Insurance Preferred Groups in Newfoundland are able to take advantage of special discounts and many extra-valuable benefits.

- Special Group Discounts

- Mortgage & Real Estate Assistance

- 0% Insurance Financing

- Home Repair Assistance

- Legal Assistance

- Health Assistance

Munn Insurance is CAA’s preferred insurance provider in Newfoundland.

- CAA Members can SAVE up to 20% on Auto and Home Insurance

- Access to multiple insurance markets; knowing you get the best coverage at the best rate

- Confidence and security of being a member of a preferred group

- Local, fast and efficient 24/7 Claims Service

- Legal Assistance

- Health Assistance

Get Newfoundland’s best leisure vehicle protection.

Newfoundlanders love their leisure time and their leisure vehicles. MyRide Leisure Insurance from Munn Insurance is the most competitive, comprehensive leisure vehicle insurance available in Newfoundland. Whether it’s your ATV, motorhome, motorcycle – or any of your leisure vehicles – A Munn policy offers more protection and value than any other program you’ll find.

- Boat and Watercraft

- ATV

- Snowmobile

- Classic Cars and Auto

- Motorhome, RV and Trailer

- Motorcycle

Car insurance laws in Newfoundland.

Newfoundland and Labrador drivers must be in possession of legally determined minimum insurance coverage to drive on our roads. These minimum limits have been enacted to ensure drivers are financially responsible if an at-fault accident occurs.

Current limits for auto insurance in Newfoundland are:

- $200,000 in liability coverage per accident

- Uninsured and unidentified motorist coverage

Newfoundland drivers are not required to carry accident benefits coverage, although most do choose to buy this coverage, which includes coverage for medical payments, disability coverage, and death benefits coverage. This type of insurance is mandatory in other provinces. Many drivers in Newfoundland also opt to increase their liability coverage to limit risk and financial exposure.

There are also other optional coverages that can be purchased. These include comprehensive and collision coverage to protect in the event of an at-fault accident or non-accident scenario such as theft.

Newfoundland car insurance – your questions answered.

Our Latest Advice

How to Save on Insurance Amid Uncertainty of Tariffs and Trade Wars

In today’s global economy, trade wars and tariffs are a hot topic, and their potential impacts reach beyond just the cost of goods like cars, appliances, and steel. If tensions between countries like Canada and the U.S. continue, you might find that your home and auto insurance premiums rise as well. While this can seem like an unavoidable cost, there are steps you can take to help protect yourself from these increases and ensure you’re getting the best possible coverage at the most affordable price.

Why Could Tariffs Cause Insurance Premiums to Rise?

Tariffs are taxes imposed on goods imported from one country to another, and they can have a ripple effect throughout the economy. For the insurance industry, one of the key areas affected by tariffs is the cost of materials used to repair vehicles and homes. For example, if tariffs are imposed on steel, aluminum, and lumber, the cost to replace or repair your home or vehicle using these materials will increase. Additionally, disruptions in the supply chain caused by tariffs and trade wars can impact the availability of critical materials, such as car parts or building supplies like windows and doors. These shortages can further drive up the cost of repairs and replacements, which insurance companies often pass along to consumers in the form of higher premiums.

But don’t worry—there are proactive steps you can take to protect yourself from the potential strain on your wallet.

6 Tips to Lower Insurance Costs Amid Uncertainty of Tariffs

Here are 6 tips to help you get the best coverage at the best rate despite the uncertainty of tariffs and trade wars:

-

Call a Local Insurance Broker (Like Munn Insurance)

One of the most effective ways to protect yourself from rising premiums is to work with a local insurance broker. Unlike large insurance companies and direct writers like the banks and national providers, brokers like Munn Insurance have access to a wide range of policies from multiple insurers. This means they can shop the market on your behalf to find the best coverage at the best price. Whether you’re dealing with rising auto rates or potential increases in home insurance premiums, a local broker will help you navigate the options and find a policy that meets your needs and budget.

-

Review Your Home and Auto Coverage with a Broker

It’s important to review your home and auto insurance coverage regularly with a broker. Make sure you have the right coverage at the right price. A broker can help you evaluate your current policy, discuss options for increasing your deductibles to reduce your premiums, and ensure that you’re receiving all the discounts you qualify for. In particular, ask about group discounts that may be available depending on your employment or membership in certain associations. A broker can help you identify these opportunities and make sure you’re getting the most value from your policy.

-

Discuss Guaranteed Replacement Cost Coverage

Understanding Guaranteed Replacement Cost coverage and whether you have it is important. For homeowners, this ensures that if your home is damaged or destroyed, your insurer will cover the full cost of rebuilding your home to its original value—regardless of how much material costs may have increased. There are some exclusions and exceptions, so be sure to discuss this coverage with your broker and understand exactly what you’re getting before you need it. It’s important to know that you’re fully covered, especially in times of uncertainty.

-

Perform Regular Home Maintenance

Taking care of your home can help you avoid significant damages that may or may not be covered under your policy, depending on the coverage you selected when setting up your policy. Regular maintenance can prevent costly repairs and ensure that your home remains in top condition. When reviewing your policy, ask your broker about the types of damage that are covered and confirm that your policy provides protection for common home maintenance issues.

-

Bundle Your Insurance Policies

Another great way to save on your premiums is to bundle your insurance policies. Consider combining your home, auto, and even recreational vehicle insurance (like for ATVs) and your seasonal properties under one provider. Bundling these policies together makes it easier for you to manage, and it allows you to take advantage of bundling discounts that can significantly lower your overall premiums. While the large directs and national providers only want to insure your Home and Auto, brokers have multiple markets that provide coverage for all of these under one roof.

-

Shop Around for the Best Deal

Premiums may rise across the board, but that doesn’t mean you can’t find a better deal. Rates fluctuate from insurer to insurer, so it’s important to shop around and compare options regularly. You can call different insurance companies directly, or, to save time, you can have a local broker do it for you. A broker has access to multiple markets, allowing them to find the best coverage at the most competitive rate, all while saving you the time and effort of making calls yourself. Brokers can help ensure you’re getting the right coverage at the best possible price.

Direct Writer Vs Broker

A direct writer offers policies from a single insurance provider. The agents that sell for a direct writer are limited in the options they can provide, as they are restricted to the coverages offered by the company they represent. They are motivated to sell you their policy not the one that’s best for you. On the other hand, insurance brokers have access to several providers and can shop around to find you the best coverage and value for your policy. This gives brokers the flexibility to continuously look for the best option for you, including when your policy renews each year.

You’re not stuck with the same insurance provider—if your premium goes up or you’re looking to make a change in coverage, your broker will do the research and make a recommendation that makes the most sense. In the case of Munn Insurance, we can shop Aviva, CAA Insurance, Intact, Pafco, Pembridge, or Travelers, to name a few. Direct writers can only quote you one market—the one they represent and work for. Brokers will give you independent advice about all of the options available to you.

Conclusion

The possibility of increased home and auto insurance premiums due to tariffs may seem daunting, but with the right strategies, you can protect yourself from unnecessary hikes. Working with a local broker like Munn Insurance, reviewing and updating your coverage, bundling your insurance policies, and making sure you have the right protections in place can help keep your premiums manageable—even in uncertain times. Keep these tips in mind, and you’ll be better prepared to navigate any potential increases that come your way.

Call Munn Insurance and Get Your Home and Auto Insurance Quote Today

At Munn Insurance, we’re committed to helping you find the best insurance quote. Whether you’re new to insurance or a seasoned pro, we make it easy to secure the right coverage at a competitive rate.

We work with a variety of providers to ensure you get the best value for your coverage, offering local expertise to guide you through the process. Don’t settle for less—let us help you navigate the options and find a policy that fits both your needs and your budget.

Ready to get started? Contact us today for a personalized home and auto insurance quote. If you have any questions or need assistance, don’t hesitate to reach out. We’re here to ensure you’re protected and saving money.

Call us at 1-855-726-8627 and let us help you get the best coverage for your needs, giving you the peace of mind you deserve amid these uncertain times.

Get the Best Auto Insurance Quote in Nova Scotia: A Step by Step Guide

When it comes to auto insurance, everyone wants to ensure [...]

Unlock Big Savings with Group Insurance Discounts

At Munn Insurance, we know that everyone loves saving money—especially [...]

Distracted Driving: The Risks and Consequences

Distracted driving is one of the leading causes of accidents [...]