Auto Insurance Tax to be Reduced in 2019.

The tax reduction on automobile insurance that the government of Newfoundland and Labrador announced when they tabled their budget in May of 2018 takes effect in the new year. This will result in a reduction on your auto insurance premiums!

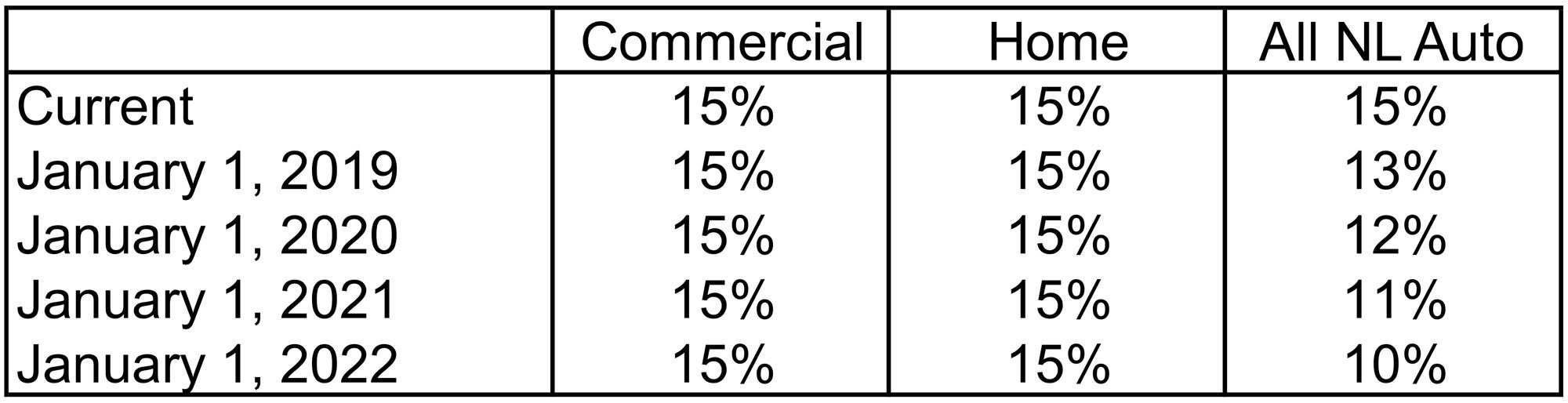

Currently, there is a 15% RST on insurance premiums and related transaction costs for property and casualty policies; for home, auto and commercial policies. As part of their budget, the government announced in May that it will gradually decrease the RST on automobile insurance premiums.

At this time the government promised to cut the tax on auto policies by 5% over four years, starting with a 2% reduction on January 1, 2019. This reduction will be followed by one per cent reductions on January 1 in 2020, 2021 and 2022.

Government has no plans to change the tax rate on commercial policies and home policies. These will continue to be subject to the 15% RST.

Here is a summary of the changes for RST on insurance premiums:

The reduction in taxes on auto policies applies to commercial auto as well. All other commercial policies will remain taxed at 15% Please note that these tax rate reductions are based on the effective date of coverage. Automobile insurance contracts that have an effective date prior to January 1st, 2019 will continue to be taxed at 15 per cent while contracts effective after December 31st, 2018 will be taxed at 13 per cent.

If you would like more information or if you have any questions on your home or auto insurance, please contact Munn Insurance at 855-726-8627 today.

Related News

Recent News

How to Save on Insurance Amid Uncertainty of Tariffs and Trade Wars

In today’s global economy, trade wars and tariffs are a hot topic, and their potential impacts reach beyond just the cost of goods like cars, appliances, and steel. If tensions between countries like Canada and [...]

Get the Best Auto Insurance Quote in Nova Scotia: A Step by Step Guide

When it comes to auto insurance, everyone wants to ensure they’re getting the right coverage at the best price. Whether you're a first-time car owner or a seasoned driver in Nova Scotia, the process of [...]

Unlock Big Savings with Group Insurance Discounts

At Munn Insurance, we know that everyone loves saving money—especially when it comes to home and auto insurance. Did you know that you may qualify for exclusive discounts just by being part of certain groups [...]